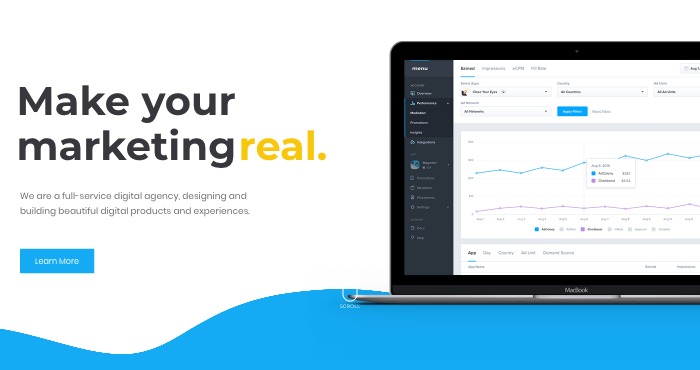

The Wealth Pool Guides You to Financial Success

Our technology helps you get your financial house in order and keep it there. Get organized with The Wealth Pool today!

HUB INTERNATIONAL MEMBERS RECEIVE THE WEALTH POOL'S PREMIUM MEMBERSHIP FREE!

As a HUB friend you are availed to this complimentary The Wealth Pool (TWP) membership — a $7 monthly savings value!

TWP is currently designed for desktop or laptop use; not mobile optimized at this time.

Receive TWP’s premium membership service upon registering your TWP account using the “DIVE IN” button and your ‘HUB TEAM’ access code.

Our platform provides robust tools and insight into how others manage their finances to help you better handle your own. Jump in the pool today!

Plans & Pricing

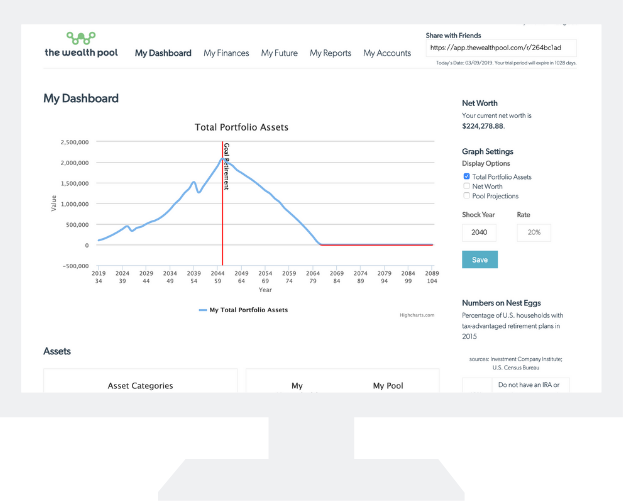

Get organized with our financial planning TOOL

A complete view into your household's financial picture

- Goal and Life Event planning modules

- Detailed, dynamic reporting

- Cash flow analysis

- Stress testing and What-if Scenarios

- Data model with over 600 categories

- Educational content

Learn from others with our insightful POOL

See how your household stacks up to others in The Pool

- Custom demographic pool comparison filters

- Aggregated and anonymized pool data insights

- Automated, granular transaction categorization

- Expenses organized by month and year

- Electronic bank account syncing

- Personal Support

Before Jumping into the Wealth Pool

Theresa was frustrated with finances.

- Getting financially motivated and organized on her own was hard

- Budgeting was boring and tracking expenses was cumbersome

- Understanding how her student loans factored into her future was difficult

- Broaching the subject of money with friends and family was uncomfortable

- And she was curious if her rent, cellphone bill, streaming subscriptions and scores of other expenses were in range with her peers

After Jumping into the Wealth Pool

It was like Facebook for Finances -- anonymously!

- She sees her total financial picture in one place

- She organizes her finances and keeps them organized

- Her spending transactions are automatically categorized against hundreds of categories

- She clearly sees where her money is going on a monthly and annual basis

- She has fun learning how her finances stack up against her peers

Maintaining Financial Wellness in the Wealth Pool

Theresa is prepared to tackle life's financial challenges!

- Her student loans are precisely mapped into her financial plan

- She dynamically adjusts her financial plan, factoring in her goals and life events

- She clearly sees when she can afford to buy her first car and home

- She sets an emergency cash reserve goal and sees how it funds through time

- She sees the power of her employer's matching contributions to her retirement savings over time